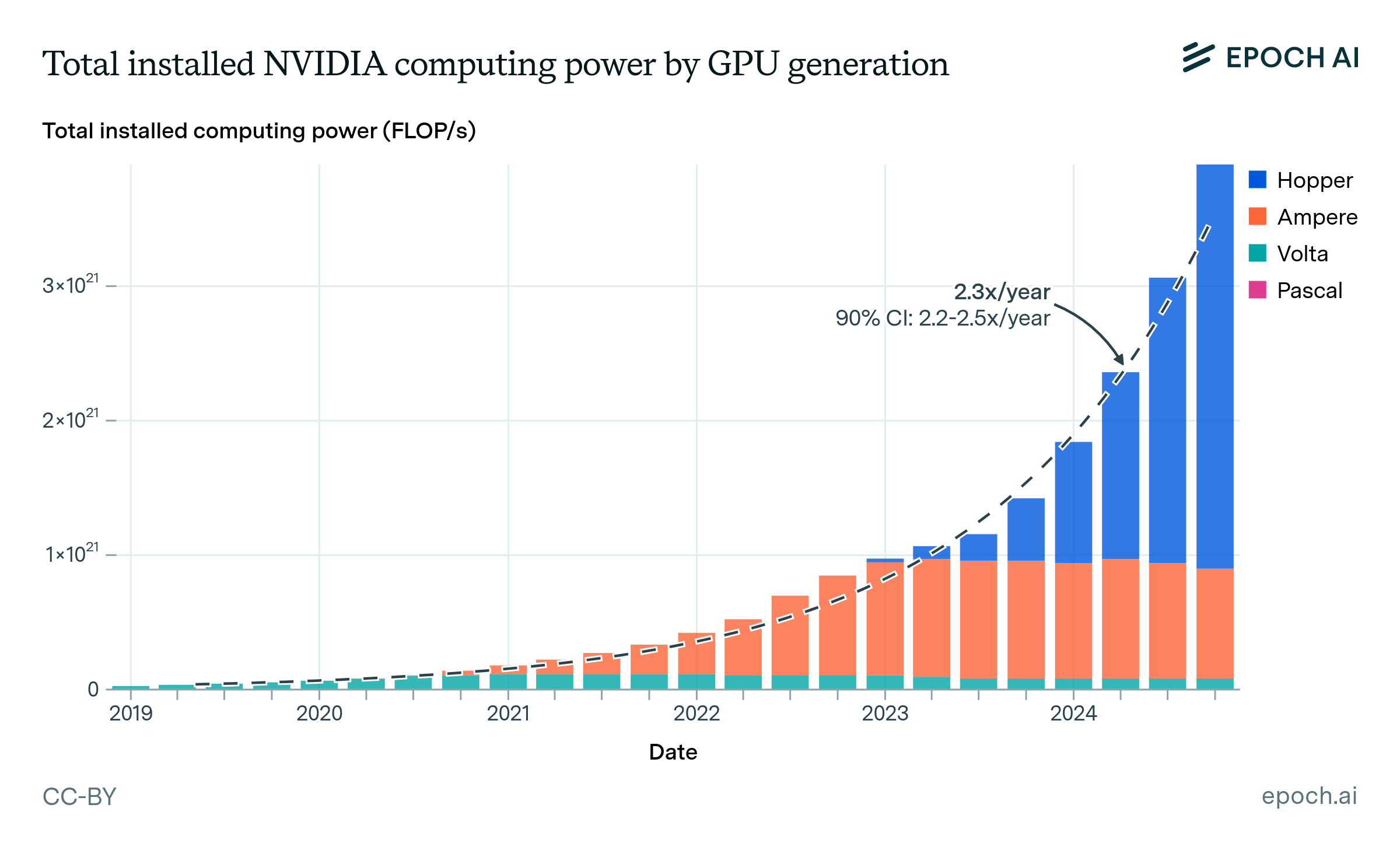

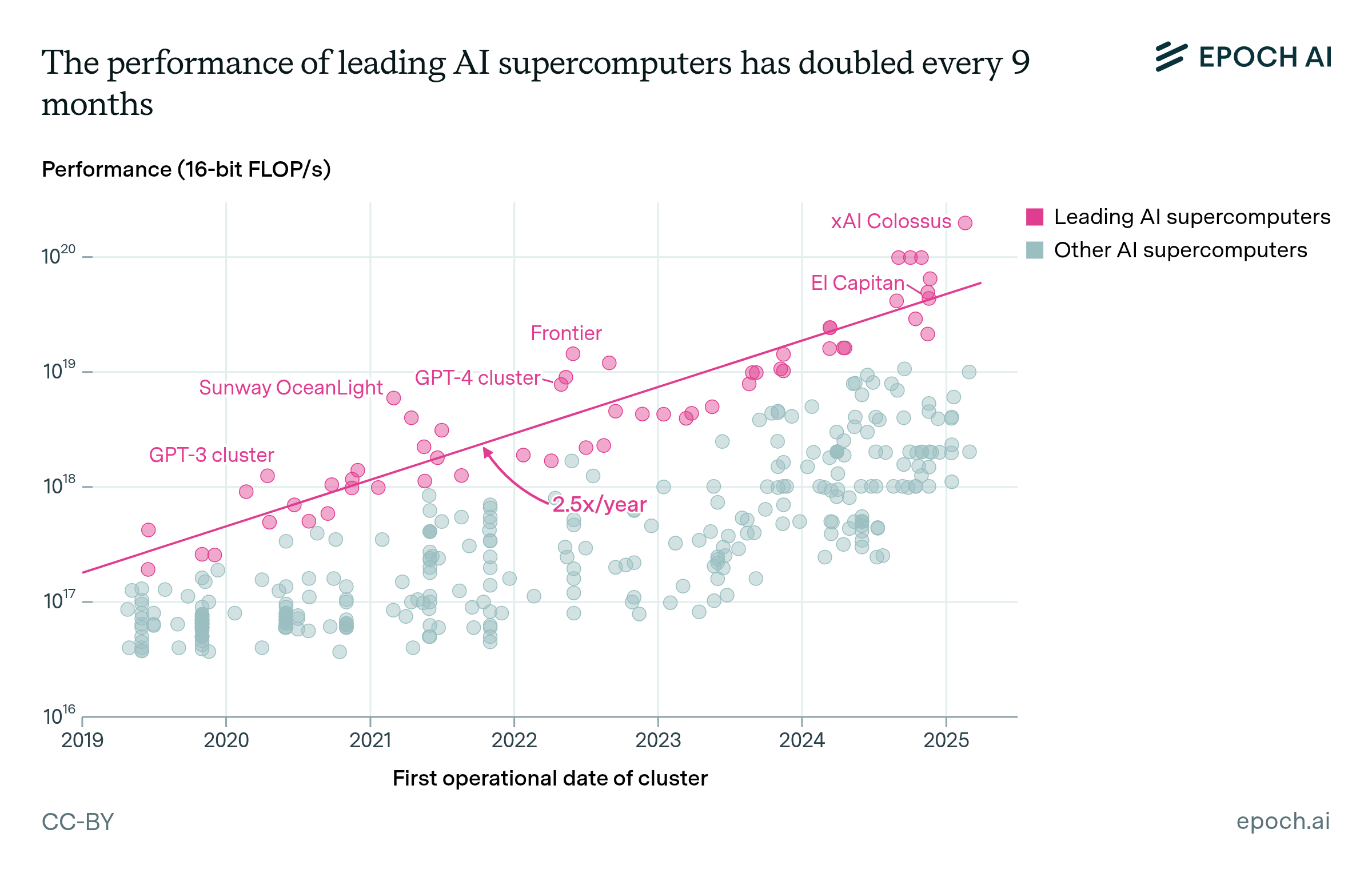

Global AI computing capacity is doubling every 7 months

Total available computing capacity from AI chips across all major designers has grown by approximately 3.3x per year since 2022, enabling larger-scale model development and consumer adoption. NVIDIA AI chips currently account for over 60% of total compute, with Google and Amazon making up much of the remainder.

These estimates are inferred based on revenue data, other financial disclosures, and analyst reports. Data coverage varies by manufacturer: Nvidia and Google data begin in 2022 while others start in 2024.

Published

January 9, 2026

Explore this data

Learn more

Overview

We fit a trend to the quarterly quantities of AI compute sold, as measured in H100-equivalents. We find that computing capacity has been growing by 3.3x per year, equivalent to a doubling time of 7 months.

Data

Our data comes from the AI Chip Sales datahub. This data is primarily obtained via financial documents and chip information collected in the ML Hardware datahub. See the AI Chip Sales documentation for more details.

Analysis

We fit a simple log-linear regression model to estimate an exponential trend in the number of H100 equivalents sold quarterly. 90% confidence intervals are obtained analytically, using standard errors on our estimate of the slope coefficient.

We estimate that global computing capacity has been growing by 3.3x per year since 2022 (90% CI: 2.7x to 4.1x). This is equivalent to a doubling time of 7 months (90% CI: 6 to 8 months).

Limitations

While we have data for Nvidia as early as 2022Q1, and for Google beginning from 2022Q4, other chip manufacturer data only starts in 2024Q1. We do not attempt to correct for the missing data in our cumulative totals, since these other manufacturers account for less than 10% of total chip production as of 2024Q1, and we believe this quantity was smaller in earlier years. The effect on estimated growth rate is likely minimal.

Our data tracks chip sales, not deployments. Actual quantities of available compute may differ on the margin due to depreciation and lags between sales and deployment. We do not account for depreciation, but it’s effects are negligible since compute quantities are growing far faster than they depreciate.