OpenAI’s revenue has been growing 3x a year since 2024

OpenAI is experiencing one of the fastest revenue growth rates in corporate history, with annualized revenue rising from $2 billion at the end of 2023 to $13 billion by August 2025. At this 3.2x annual growth rate, OpenAI is on track to exceed $20 billion in annualized revenue by the end of the year.

Authors

Published

October 14, 2025

Learn more

Data

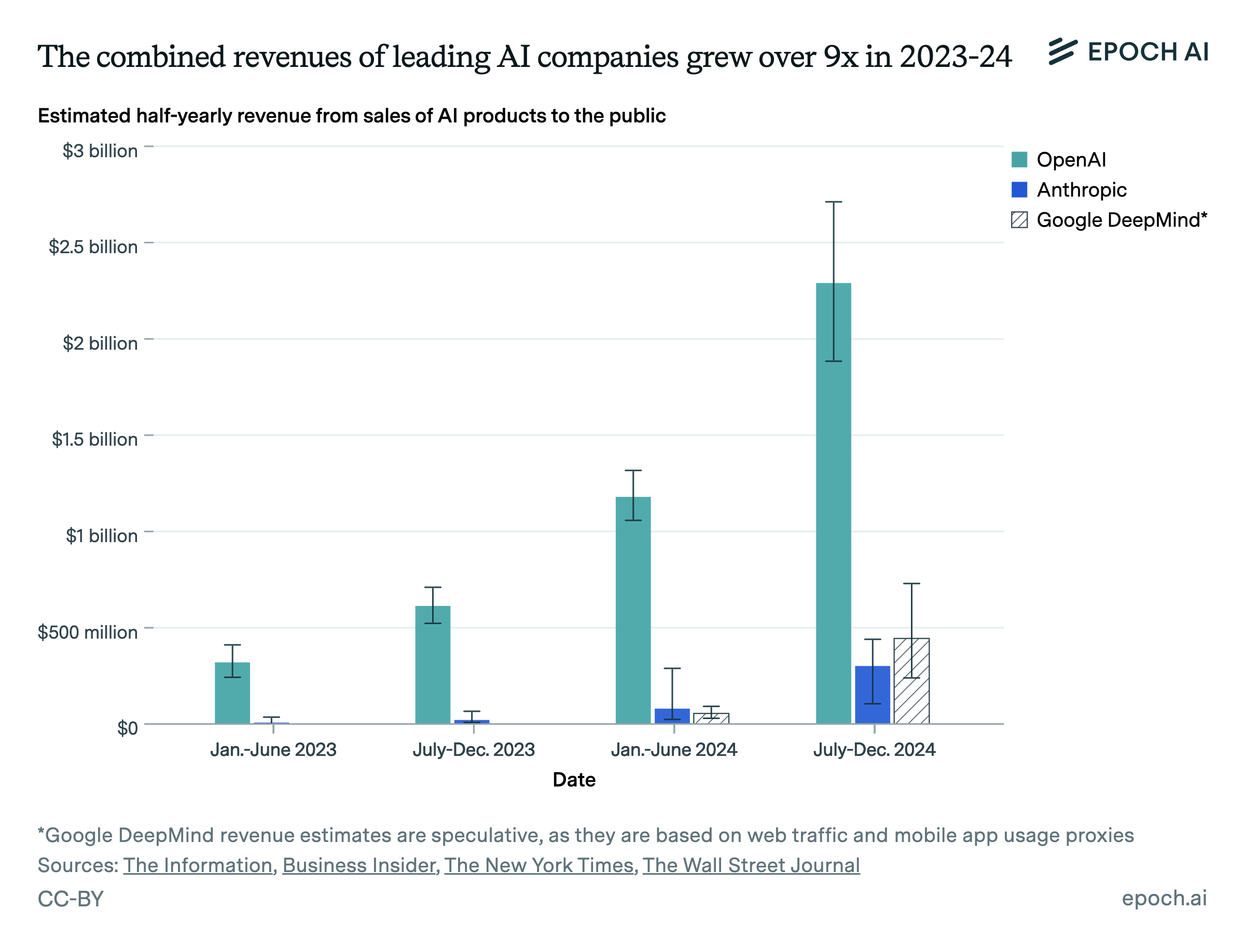

Company revenue data is taken from the Epoch AI Companies Data Hub.

Analysis

We analyzed OpenAI’s revenue growth using a Bayesian Information Criterion (BIC) model selection framework. We fit two candidate models: a single-exponential growth model (constant growth rate in revenue) and a continuous two-segment exponential model that allows for a structural break in growth rate. The BIC analysis identified a breakpoint at the end of 2023, suggesting a change in OpenAI’s growth trajectory at that time. BIC penalizes additional parameters so that the more complex model is only chosen when it provides a substantially better fit to the observed data. This helps identify periods of revenue acceleration or deceleration while avoiding overfitting on sparse points.

We plot all data points from December 31, 2023 onwards to demonstrate the rate at which OpenAI’s revenue has been recently growing. To generate a prediction interval, we used bootstrap sampling with replacement (n=5000).

| AI Company | Time Period | Growth Rate per year | 90% Prediction Interval |

|---|---|---|---|

| OpenAI | March 1st, 2023 - December 31st, 2023 | 13.8x | 9.5 - 20.0x per year |

| December 31st, 2023 - August 1st, 2025 | 3.2x | 3.0 - 3.4x per year |

Code for our analysis and the plot is available here.

Assumptions

Our analysis draws on publicly reported revenue data compiled in Epoch AI’s company database. This dataset aggregates information from direct statements by company executives, official press releases, and reputable media reports, typically based on insider disclosures or obtained documents. We rely exclusively on public sources rather than proprietary financial databases, to maintain transparency and replicability. Each data point is rated “Confident” or “Likely” depending on its source credibility and specificity—official company disclosures are weighted more heavily than secondhand reports.

Individual observations are inherently uncertain. Companies may misstate performance, whether intentionally or through differing accounting practices, and journalistic estimates can vary in accuracy. We mitigate these risks by using reported annualized revenues rather than shorter-term metrics and by cross-referencing multiple reports when possible. Still, data gaps and inconsistent reporting intervals introduce noise.