The combined revenues of leading AI companies grew by over 9x in 2023-2024

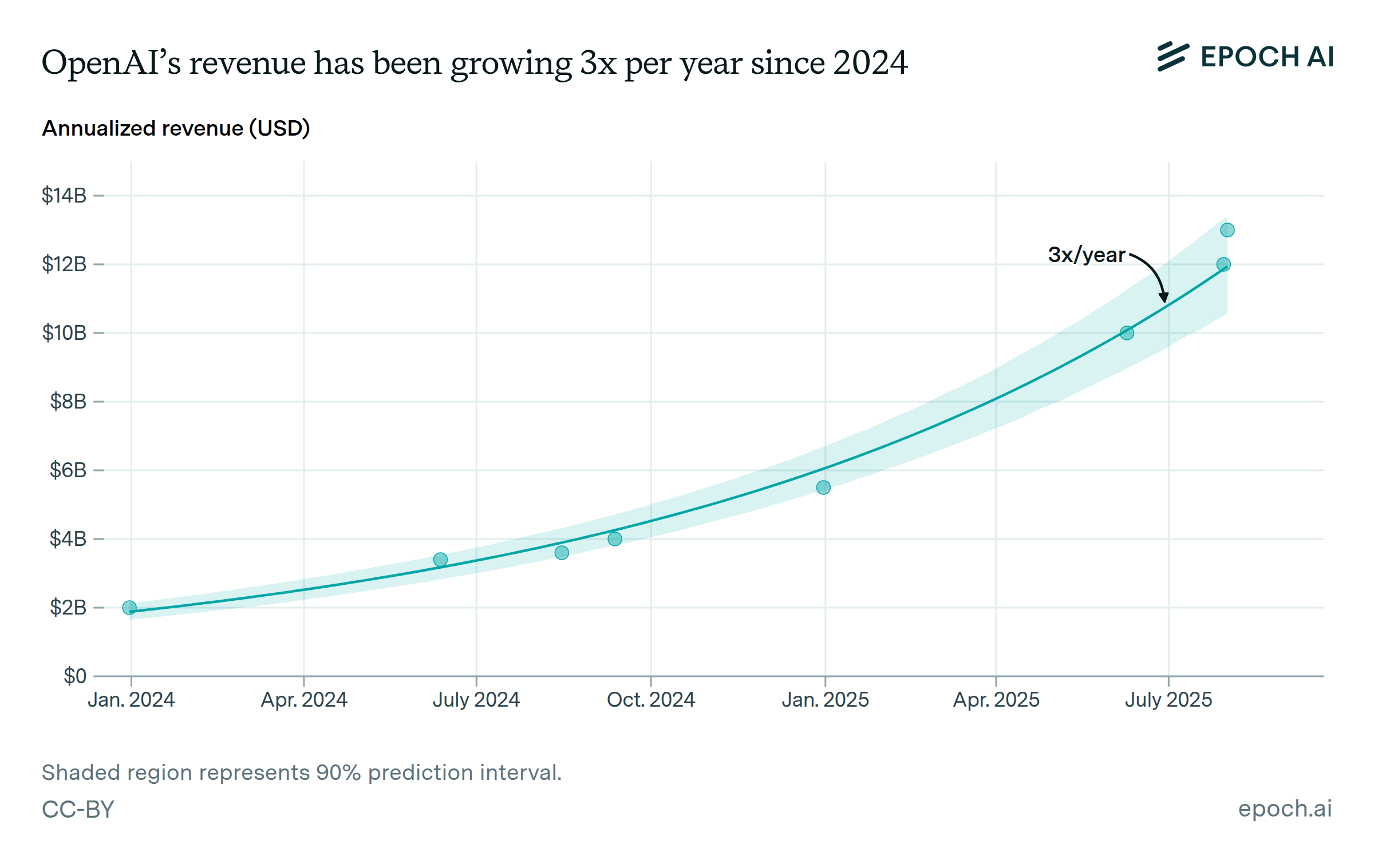

OpenAI, Anthropic, and Google DeepMind each grew their revenue over 90% in the second half of 2024, corresponding to an annualized growth over 3x/year. OpenAI’s and Anthropic’s revenue projections both imply that their revenue will continue to grow over 3x in 2025. Projecting to April 2025, we estimate OpenAI’s revenue at around $10B/year, while Anthropic and Google DeepMind each earn single digit billions per year. Note that our estimates for Google DeepMind are more speculative, and don’t include internal revenues from integration with Google products, which could be substantial.

According to our estimates, no other AI company surpassed $100 million in revenue in 2024 by selling access to their own models. However, companies such as Microsoft and Amazon collectively make more revenue than top AI companies by charging for access to third-party models. Microsoft alone reports $13B in revenues from its AI business, seemingly driven by sales of Copilot (which uses OpenAI models).

Authors

Published

April 3, 2025

Learn more

Overview

We estimate half-yearly revenues from leading AI companies selling access to their models. We focus on OpenAI, Anthropic, and Google DeepMind, as these are the companies where we estimate highest sales revenues. We estimate that other AI companies made less than $100 million in revenue in 2024.

For OpenAI and Anthropic, we fit exponential trends to revenue numbers from media reports. For Google DeepMind, we compare web traffic and mobile app data for Gemini with the same measures for ChatGPT and Claude.

Note that our estimates capture only revenues from external customers that companies generate with their own models. This means we don’t include internally generated value (e.g. potential improvements to Google Search via the “AI Overview” feature), or revenue from third-party models (e.g. Microsoft’s revenues from selling OpenAI models via Microsoft Copilot). We also ignore revenue streams that are not primarily generated by AI products (e.g. research agreements).

Code to reproduce our analysis is available here.

Data

We use media reports of OpenAI and Anthropic revenue to estimate those companies’ revenues across 2023 and 2024. These are typically reports of figures from investor materials, or statements from company leadership. For OpenAI, we found media reports of total revenue in 2023, as well as 7 instances of reported monthly revenue. For Anthropic, we found 4 instances of reported monthly revenue. This data is shown below.

| Company | Date or period | Reported revenue (annualized) |

|---|---|---|

| OpenAI | 2023 | $1 billion* |

| OpenAI | “Start of 2023” | $210 million |

| OpenAI | 2023-08-29 | $1 billion |

| OpenAI | 2023-10-15 | $1.3 billion |

| OpenAI | 2023-12-30 | $1.6 billion |

| OpenAI | 2024-06-12 | $3.4 billion |

| OpenAI | 2024-09-12 | $4 billion |

| Anthropic | 2023-10-03 | $100 million |

| Anthropic | 2025-01-08 | $875 million |

| Anthropic | 2025-02-24 | $1.2 billion |

| Anthropic | 2025-03-11 | $1.4 billion |

*Starred values are annual totals, rather than annualized from a shorter period.

Sources: The Information, Business Insider, The New York Times, The Wall Street Journal

For our estimates of Google DeepMind revenues, we use publicly available third-party estimates of monthly visits to chat interface webpages, monthly active users for chat applications, monthly mobile app downloads, and monthly visits to the API documentation.

Analysis

We estimate monthly revenues for Anthropic from January 2023 to December 2024 by fitting exponential growth to the four reported monthly revenue figures. We sum the estimated monthly revenues to obtain our half-yearly revenue estimates.

For OpenAI, we account for a jump in revenue due to the February 2023 launch of ChatGPT paid subscriptions. For August 2023 onwards, we fit exponential growth. For February to August 2023, we separately fit exponential revenue growth to match the total 2023 revenue when the entire year is summed. As with Anthropic, we sum the monthly revenues to obtain half-yearly revenues.

We model uncertainty in reported revenues for the date of each report (normal distribution with 90% CI of ±~2 weeks) and the revenue (normal with 90% CI of ±30%). We model additional uncertainty for Anthropic, since there is a gap of over 1 year between the first and second revenue report. We sample a range of plausible piecewise interpolations between these data points, allowing between 10% and 90% of revenue to occur at a date between 10% and 90% of the way through the gap. For all uncertainty estimates, we run 1,000 Monte Carlo samples, re-fitting or re-interpolating in each sample, then take percentile bands across the resulting revenue trajectories to form our confidence intervals.

Google DeepMind reported a revenue of £1.5B (equivalent to $1.9B) for 2023. However, it’s unclear how to infer revenue from external customers from this figure, because it represents “research and development remuneration from other group undertakings”. Because of this, we instead estimate Google DeepMind’s customer revenue using web traffic and mobile app usage data.

To estimate Google DeepMind’s subscription revenue at the end of 2024, we use three different proxies. First, we leverage monthly active users data for the Gemini, ChatGPT, and Claude mobile apps from DataReportal. Second, we use mobile app download statistics from Business of Apps and Backlinko. Third, we analyze chatbot webpage monthly visits from Similarweb. For each case, we assume Google DeepMind derives comparable subscription revenue per user interaction as OpenAI and Anthropic, within a 5x factor of uncertainty. We take the geometric mean of these estimates to form our final estimate for subscription revenue.

For API revenue estimation, we use developer documentation webpage visits from Similarweb as a proxy for API usage. We assume Google DeepMind derives comparable API revenue per developer webpage visit as OpenAI and Anthropic. As we did for the subscription revenue, we take the geometric mean of these estimates to form our final estimate for API revenue. We then add the subscription and API revenue estimates together to get our total revenue estimate for the end of 2024.

To extrapolate Google DeepMind’s revenue through 2023-2024, we calculate the monthly growth rate of each proxy metric for Google DeepMind. We apply this growth rate to our December 2024 estimates to generate a complete monthly revenue series. We assume subscription revenues were zero before April 2024, as Gemini’s first paid plan launched in February 2024 with a two-month free trial.

We use a similar Monte Carlo approach for DeepMind, sampling 1,000 times over key input parameters (usage metrics, subscription fractions, etc.). We model our uncertainty over the real value of revenues per proxy unit as a 90% confidence interval between ⅕ and 5x of the value for OpenAI and Anthropic. We also model uncertainty over the growth rate, sampling noise from a 90% confidence interval between 0.8 and 1.2 of the estimated growth rate. For each sample, we compute a revenue trajectory, then form confidence intervals by taking percentiles across all samples.

Our revenue estimates for OpenAI and Anthropic align reasonably well with public estimates made by others – the disagreement between our estimates and the estimates we found vary from 0% to 15%. On the other hand, our revenue estimates for Google DeepMind disagree with other public estimates by 48% to 85%, although it’s unclear whether these estimates are focused on external customer revenues, so this might not be a like-for-like comparison.

Assumptions

-

We obtain our revenue figures from media reports, which are generally based on comments from OpenAI and Anthropic representatives, as well as leaked financial documents in some cases. We explicitly model uncertainty in the timing and accuracy of these reports.

-

We focus our analysis on revenues from external customers, omitting “implicit” internal revenues. For example, Google may generate significant additional search engine revenue by using Google DeepMind’s models in its “AI Overview” product, but we do not take this kind of company-internal revenue into account. These internal revenues might be much larger than external customer revenues for Google DeepMind.

-

Similarly, we only include revenues generated by models developed in-house. For example, Microsoft Copilot and Azure sell access to OpenAI and other companies’ models, and are perhaps the largest source of AI revenues (reportedly generating $13B in annualized revenues as of January 2025). There may be considerable revenue accruing to providers like AWS and Google, whose cloud infrastructure is used to serve third-party models.

-

Google DeepMind’s revenues are estimated using web traffic and app usage proxies. While we explicitly model uncertainty in revenue per unit of each proxy, there are likely biases between organizations. For instance, many third party developers have replicated the OpenAI chat endpoint API for their own models, which may drive additional web traffic to the OpenAI developer documentation that does not translate into revenue.

-

We believe that no other AI companies had direct revenues of over $100M in 2024. The table below shows our analysis for other prominent companies.

| AI lab | Comment |

|---|---|

| Meta |

Meta likely has access to a quantity of AI chips comparable to the three companies we focus on. However, there is little public information regarding Meta’s revenue from their LLMs, and the information we have suggests that their revenue is significantly lower than the three leaders. Meta’s flagship Llama series of models is open weight and can be downloaded and self-hosted. Meta provides access to Llama models through a web interface similar to ChatGPT, but this is a free service, and additionally, Meta does not provide a paid API service. Meta has said they have licensing agreements with cloud providers to host Llama models, but this does not appear to be a significant revenue stream for Meta. Note that Meta might derive very large economic value from its LLMs through integration with Meta products, but our current analysis focuses on revenues rather than internal economic value. |

| xAI |

xAI has access to a large quantity of AI chips, and recently released frontier LLM Grok 3. However, public evidence suggests that its annual revenue has been lower than that of the three companies we focus on. For example, a Business Insider article from February 2025 reports that xAI plans to make $100 million annual revenue, suggesting that its revenue in 2024 was less than $100 million. |

| DeepSeek |

We believe that DeepSeek was unlikely to have had substantial (>$100 million) revenues prior to the full release of DeepSeek’s R1 model in January 2025. However, proxy data from web traffic and OpenRouter suggests 2025 H1 revenues may be similar in magnitude to those from Anthropic or Google DeepMind. |

| Cohere |

In February 2025, Yahoo Finance stated that Cohere’s annualised revenue had exceeded $70 million, and that its revenue was over 3x smaller 12 months earlier. This suggests that Cohere’s 2024 revenue was significantly less than $70 million. |

| ByteDance |

ByteDance’s primary exposure to generative AI is currently through its subsidiary Doubao. Doubao recently released a flagship model, Doubao-1.5-pro, and their website states that they are generating 4 trillion tokens per day. If we assume all of these tokens are generated using Doubao-1.5-pro at stated prices, we get a loose upper bound on annualized revenue of $220 million USD. However, this is probably an overestimate, since they also have a cheaper “lite” model, and most of these tokens are likely generated by their free app. |

| Alibaba/Moonshot AI |

Moonshot AI’s Kimi was the most popular AI service in China as of January 2025. It is difficult to determine revenues, since the proxy metrics used for western models likely underestimate usage for Chinese models. |

| Mistral |

In January 2025, The Information reported that Mistral’s annualised revenue was around $40 million as of November 2024, suggesting that Mistral’s 2024 revenue was not much higher than $40 million. |