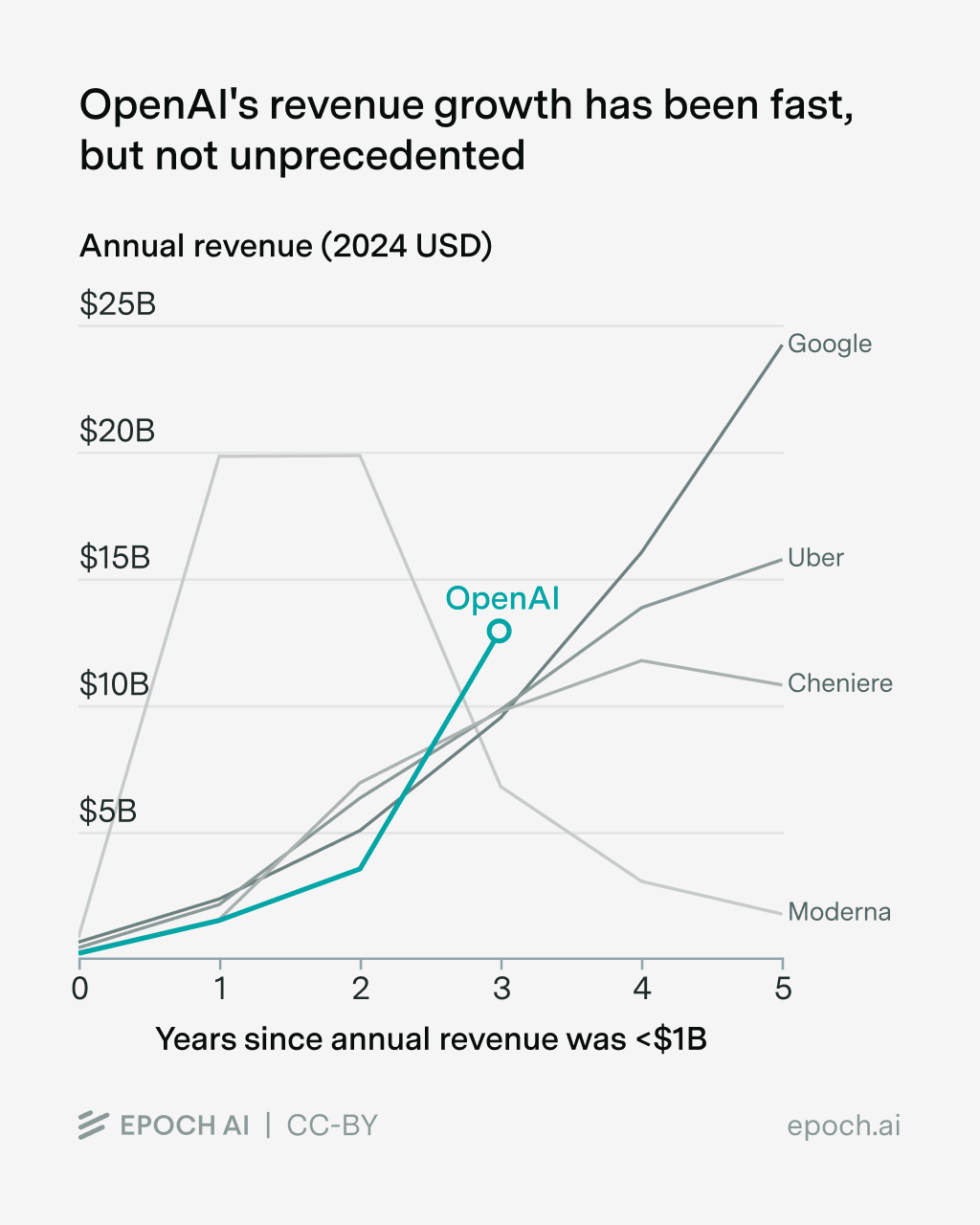

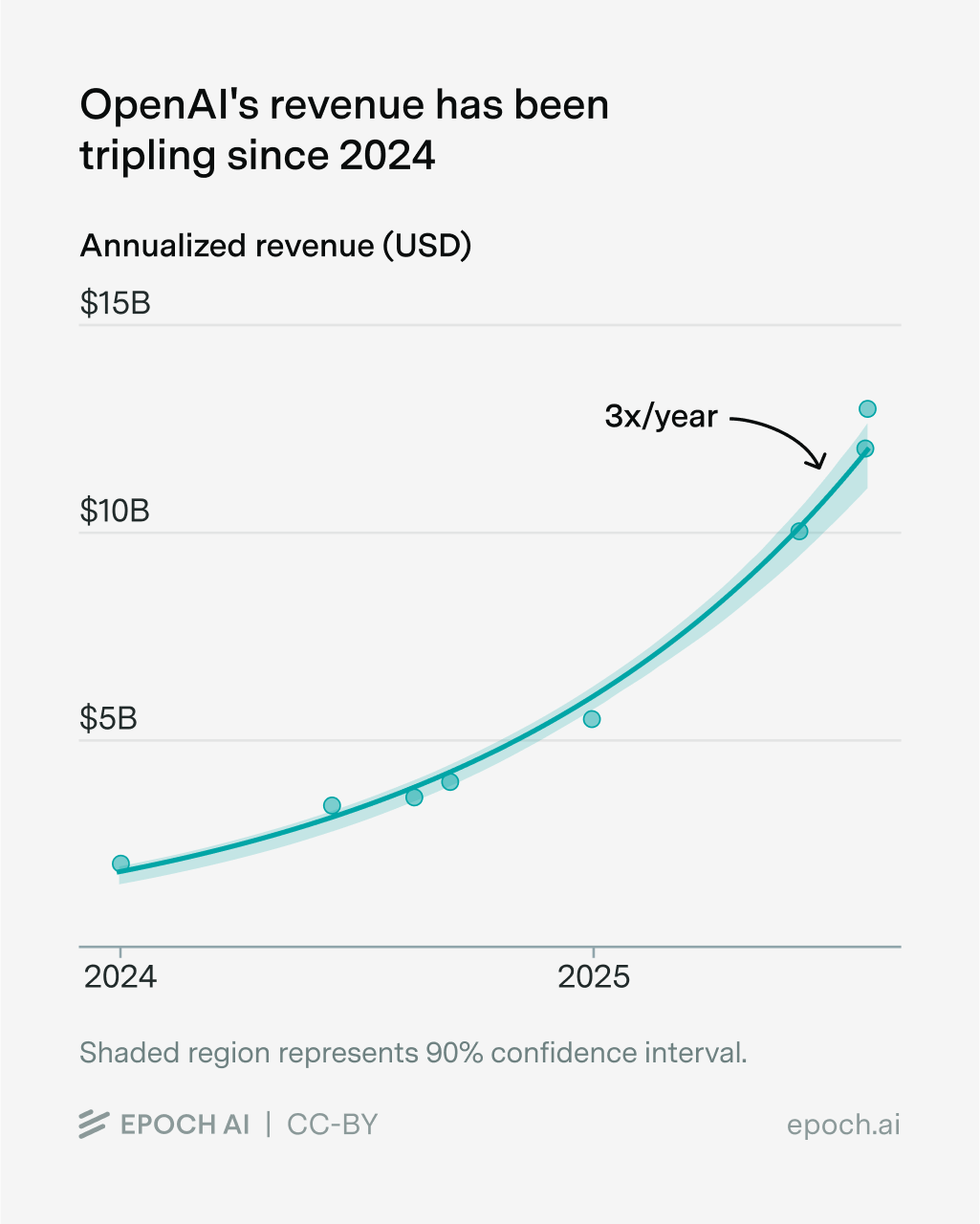

Epoch’s new AI companies database shows the remarkable level and pace of growth of OpenAI’s revenue. It first exceeded $1 billion in 2023 and will exceed $10 billion in 2025. This is impressive, but not unprecedented — a few other companies have matched this growth rate historically.

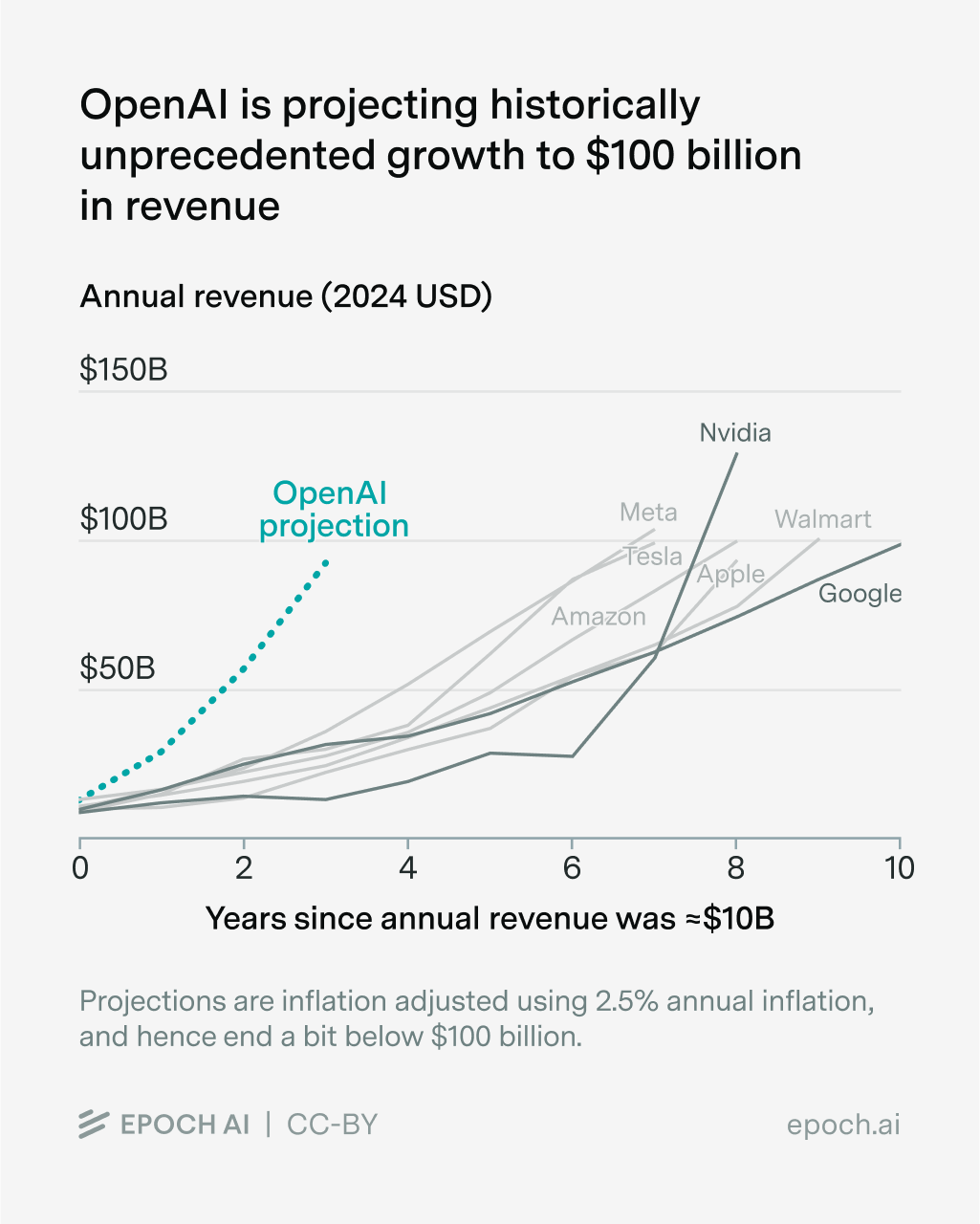

OpenAI’s projections, however, are a different story. According to The Information, in Q3 2025 OpenAI projected its 2028 revenue to be $100 billion. I couldn’t find any examples of a company growing its revenue from around $10 billion to $100 billion in such a short period of time.

What happens if OpenAI falls short of these projections? At a minimum, it would likely have to scale back its plans for large compute build-outs. The recently-announced deals with Nvidia, AMD, and Broadcom imply expenditures of roughly $1.3 trillion within the next decade, and some of this is presumably expected to be financed by revenue or debt raised against revenue.1

But the second-order effects of a miss could be larger. This is because investors and other companies are increasingly betting big on OpenAI being highly valuable. As Noah Smith recently wrote, these bets depend not only on this value being realized, but on it being realized fast enough to cover the debt used to finance the bets. Failing to deliver value as fast as investors expected is all it took to turn several historical technology booms into busts.

We don’t know how sensitive the AI financing system is to OpenAI’s specific projections. It’s possible that there is a big margin of error and the tenor of the deals is, “Even if we miss our revenue projections, we all still get rich.” But it seems just as possible that more is at stake.

One thing we can say: OpenAI hitting its projections would be a historic achievement.

OpenAI’s revenue grew very quickly from $1B to $10B

I found four instances of US companies in the past fifty years growing their revenue from less than $1 billion to over $10 billion over the course of three years.23 It’s a somewhat eclectic group.

The one company to clearly cross these thresholds faster than OpenAI was the vaccine maker Moderna, whose revenue spiked in 2021 due to the pandemic. Another demand-driven entry is Cheniere Energy (2015–2018), which rode the US natural gas boom. Uber (2014–2017) and Google (2002-2005) are familiar tech startup success stories.

Being a pure software company, Google may be the most apt comparison to OpenAI. Of these four, only Google went on to hit $100 billion revenue. The others have yet to pass $40 billion.

OpenAI’s recent growth does look fast compared to the others. It is currently growing around 3× per year, compared to Google’s 2× per year in the year when it first hit $10 billion. So, apart from Moderna, OpenAI may be the fastest-growing company to hit $10 billion. Can it keep up the pace?

No company has grown its revenue from $10 billion to $100 billion in three years

OpenAI expects to make $13 billion in revenue in 2025 and projects to grow its revenue by 2.3× in 2026, 2× in 2027, and 1.6× in 2028. I couldn’t find any historical examples of companies growing at such a fast pace from such a high level. The following chart shows the seven US companies I could find in the past fifty years that grew their revenue from $10B to $100B in less than a decade.4

The fastest companies to cross these thresholds were Tesla and Meta in seven years, followed by Nvidia, Apple, and Amazon in eight, Walmart in nine, and Google in ten. The median annual revenue growth rate of these companies during this high-growth period is 1.3×. From this perspective, OpenAI is targeting an unprecedented performance.

However, the chart also shows the arbitrariness of the thresholds. Yes it took Nvidia eight years to go from $10 billion to $100 billion, but almost all of that growth came in just two banner years toward the end of the period, both a bit over 2× per year, starting from a base of about $28 billion. This is the most optimistic reference point for OpenAI.

I also looked for any company with revenue over $10 billion (in 2024 USD) that more than doubled its revenue in a single year. As just mentioned, Nvidia did this twice. I only found two other examples. Gilead Sciences went from $11 billion in 2013 to $25 billion in 2014, driven by the success of a new hepatitis C drug. Cheniere Energy grew its revenue from $16 billion in 2021 to $33 billion in 2022, riding another natural gas price spike. Both companies’ revenues plateaued and declined over the subsequent two years.

I focused on recent US companies to isolate factors like market access, political economy, and the availability of capital. Looking beyond the US, the only stand-out example of rapid revenue growth that I could find was ByteDance, the parent company of TikTok. In 2024 USD, its revenue first crossed $10B in 2019 and first crossed $100B in 2024, five years later.

Can OpenAI do it?

The outside view says: probably not. Companies usually don’t do this. Does a closer look reveal anything different?

The strongest argument in OpenAI’s favor is probably, as mentioned above, that its revenue is growing very quickly right now: 3× per year. All data points since 2024, even recent ones, are consistent with this trend. Given that, its growth could slow somewhat while still hitting the target.

There also appears to be a trend toward companies hitting $100 billion in revenue faster. Of our seven examples above, six hit $100 billion in the last fifteen years. If there is some general dynamic by which this happens faster over time, it could be a tailwind for OpenAI.5

Where might this revenue come from? It probably won’t be ChatGPT subscriptions alone, which currently account for about 75% of OpenAI’s revenue. OpenAI projects only $50 billion of its 2028 revenue to come from ChatGPT directly. As a reference point, that is the cost equivalent of 210 million of today’s “Plus” subscriptions. The most recent figures, from April 2025, show 20 million paid subscriptions of all kinds.

OpenAI also seems likely to make a play for the advertising and shopping revenue that currently flows through Google, Amazon, and Meta. Their main tool here will be the much larger user base of ChatGPT’s free tier. Winning market share in this relatively mature sector is at least plausible.6

Or maybe that’s thinking small. The promise of AI, after all, is broad productivity. For a very rough estimate, let’s imagine that:

- OpenAI’s current and near-term products could provide an average 10% productivity uplift for all remote-compatible work tasks, and

- OpenAI can capture 10% of the resulting value.7

We previously estimated that about a third of US work tasks are remote-compatible, and that is probably lower globally. So, assuming these tasks account for around 20% of the roughly $110 trillion of global GDP, the total potential revenue from this near-term productivity uplift might be around $220 billion.8

There will be competition for this revenue, but perhaps OpenAI can maintain its current relatively high market share. Maybe AI itself can lower the hurdles to adoption, helping people quickly figure out how to use it to be more productive.

Still, reaching such heights in just three years would be an extraordinary achievement. History suggests that it doesn’t happen quite so fast.

What if not?

Maybe if OpenAI “merely” gets to $50 billion in 2028—an impressive feat in its own right—it will only have had to slow its data center build-outs, and will otherwise remain financially healthy. But the more stakeholders take big bets on OpenAI, the riskier such misses become. We’ll be paying close attention to OpenAI’s next few revenue prints.

Thanks to Steven Kryger and Shanu Mathew for feedback on this post.

Notes

-

The deals total 26 GW of chips, and a 1 GW data center costs roughly $50 billion to build, all-in. Precise timeframes of the deals are not available, but all plans discussed publicly cite dates within the next decade.

-

I don’t have access to a comprehensive database of company revenue. My methodology for this post relied in large part on queries to GPT-5 Pro, Grok 4 Heavy, and Gemini 2.5 Deep Think, combined with manual spot checks. If you know of examples of companies achieving faster revenue growth off larger bases than what I discuss, please tell me! greg@epoch.ai or @GregHBurnham.

-

All analysis in this post excludes cases of revenue growth driven primarily by mergers and acquisitions.

-

The first year shown for each company is either the first year when the company’s revenue exceeded $10 billion, or the year prior to that, if the company’s revenue in this prior year was closer to $10 billion than the company’s revenue in the subsequent year. The range of revenues in this “Year 0” is $9-13 billion, with OpenAI’s toward the upper end of the range. Shifting the rest of the cohort one year earlier doesn’t change the main observation.

-

Perhaps the better way to think about the $100 billion milestone is as a percent of GDP: in that case, as GDP grows, the milestone gets easier to achieve.

-

Of course, if the tech giants face fierce competition in their core businesses, they may have to scale back their own AI investments. That could cause its own set of problems, depending on what other companies are levered to those anticipated expenditures.

-

These numbers are speculative. Uplift estimates vary widely and include negative effects. One estimate of the consumer surplus of AI puts it at about 10× revenue.

-

The eventual total addressable market for AI is much larger. The question here is rather how much can be captured in the next three years, given current AI capabilities and diffusion.

About the authors